Tax Efficient Fund Placement

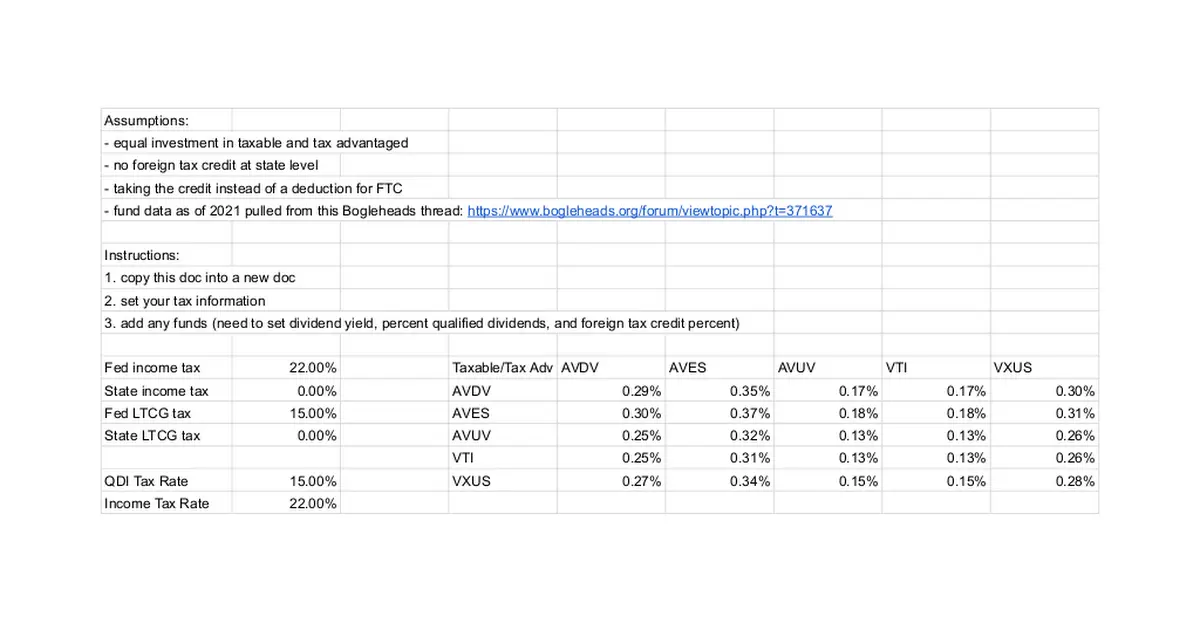

This is a link to a spreadsheet to help determine which funds to place into taxable vs tax-advantaged space.

Here is a link to the Bogleheads wiki about tax-efficient fund placement:

If all else is equal, international funds have a small tax advantage over US funds, because they are eligible for the foreign tax credit.

TL;DR:

This wasn't good enough for me, especially as I'm looking into applying a small-cap tilt to my portfolio and really like optimizing things, so I went digging for more information.

When you own stocks or otherwise make money in another country, that other country may charge taxes, and the IRS will also charge taxes on any dividends you receive, regardless of source. This end